Let me state this very clearly. This article is not about stocks vs. bonds. A savvy investor will have a mix of both. The art of investing is how you use both in your portfolio. Bonds are not as sexy as stocks and will never yield the same potential rate of return as a stock, however, it is still important to have bonds in your portfolio for the following reasons.

1. Diversification is key to smart investing

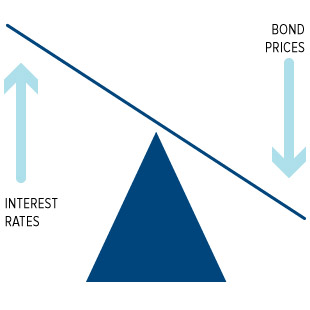

Depending on your comfort level of investing, you may try to hedge risk or you may be very aggressive. Either way, bonds should be included in your portfolio. Stocks can offer you growth and capital gains while bonds provide income and can help protect your assets during more volatile times. By holding bonds, in addition to stocks and other investments, you’re not putting all your eggs in one basket. Although stocks can go up, they can also go down — sometimes a lot. Think of bonds as loans. You are putting yourself in a position to lend the government, municipalities, and companies money when they are looking to borrow. When the market is uncertain, you usually see investors run away from stocks and turn to high-quality bonds. But rule of thumb is when interest rates go up, bond prices go down.

Depending on your comfort level of investing, you may try to hedge risk or you may be very aggressive. Either way, bonds should be included in your portfolio. Stocks can offer you growth and capital gains while bonds provide income and can help protect your assets during more volatile times. By holding bonds, in addition to stocks and other investments, you’re not putting all your eggs in one basket. Although stocks can go up, they can also go down — sometimes a lot. Think of bonds as loans. You are putting yourself in a position to lend the government, municipalities, and companies money when they are looking to borrow. When the market is uncertain, you usually see investors run away from stocks and turn to high-quality bonds. But rule of thumb is when interest rates go up, bond prices go down.

1 of 5 NEXT

[fbcomments url=”http://urbanmoney.org/project/5-reasons-to-invest-in-bonds/” width=”790″ count=”off” num=”30″ countmsg=”wonderful comments!”]