You have to admit, this is COOL! What I love must about this story is the mother challenging her son to learn. This led to him doing research which led to him investing at an early age. To be 15 years old and worth $50,000 is pretty cool if you ask me. What would be even cooler is if we all challenged our children the way this parent challenged hers.

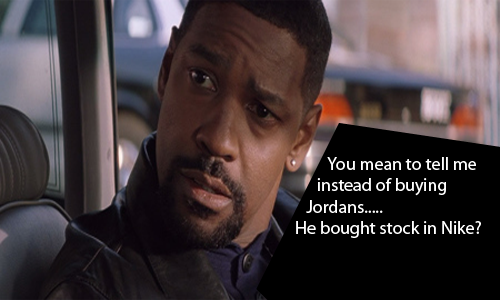

15 YEAR OLD TEEN WORTH $50,000!!MUST WATCH!SHARE!!!$200 dollar pairs of Jordans on your feet or own a piece of Nike. Lets raise some SHAREHOLDERS!!SHARE!!

https://takechargenow.wufoo.com/forms/z1ayhj2h09tiq0l/

Posted by Andre Devon Sullivan on Monday, December 22, 2014

What did he say check for

Before he buys any stock, he looks for certain ratios. First, he said he looks for the P/E (Price to Earnings) Ratio. A valuation ratio of a company’s current share price compared to its per-share earnings.

Market Value per Share / Earnings per Share (EPS)

For example, if a company is currently trading at $43 a share and earnings over the last 12 months were $1.95 per share, the P/E ratio for the stock would be 22.05 ($43/$1.95). In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E.

The ratio for this is Annual Dividend Per Share divided by Price Per Share.

Read more: http://www.investopedia.com/terms/p/price-earningsratio.asp#ixzz3YRdXAJ00

Next is the dividend yield ratio. A financial ratio that shows how much a company pays out in dividends each year relative to its share price. Dividend yield is a way to measure how much cash flow you are getting for each dollar invested in an equity position – in other words, how much “bang for your buck” you are getting from dividends. Investors who require a minimum stream of cash flow from their investment portfolio can secure this cash flow by investing in stocks paying relatively high, stable dividend yields.

Third ratio is to consider is the growth ratio. The amount of increase that a specific variable has gained within a specific period and context. For investors, this typically represents the compounded annualized rate of growth of a company’s revenues, earnings, dividends and even macro concepts – such as the economy as a whole.

[fbcomments url=”http://urbanmoney.org/project/from-buying-nike-shoes-to-buying-nike/” width=”790″ count=”off” num=”30″ countmsg=”wonderful comments!”]