I think majority of us have been in a situation where our credit score or history has prevented us from getting something. If only we had the right information about credit, maybe we could avoid some of these unfortunate situations. Lets take a look at a few tips that can help you maintain a high credit score.

Establishing credit

The longer you have tradelines on your credit report, the stronger your credit history will be and the higher your credit score will be. Therefore, it is important to establish credit at an early age. A sure way to do this is to add your adolescent as an authorize user on a credit card that has a high credit limit, no late payments, and a long credit history. If you are already an adult, you need to establish at least four tradelines. A car loan, a two credit cards, and your student loans will count as four examples. It is important that you don’t get any late payments on anything.

Capacity Used

If you have a credit card that has a credit limit of $700, don’t use the entire $700. This will hurt your credit score. You typically don’t want to use more than 30$ of your credit limit in a given month. However, I understand things happen. So if you are forced to use more than 30% of your credit limit, try to pay it down to 30% of the limit or pay it off as soon as possible.

Late payments

Not paying your bills on time can hurt your credit severely. Additionally, it is incredibly difficult to recover when you have multiple late payments. Here is a little bonus for you. Try to avoid having any late payments within the past 24 months when applying for a car loan and past 12 months when applying for a home loan. If you have a late payment that is on your credit report when applying for a car loan, your interest rate will be higher. If you have a late payment within the past 12 months when applying for a home loan, you will not be able to qualify for a mortgage.

Type of credit you have

This is one little rule that many don’t know will hurt them. Just like your investment portfolio, it is important to have a diverse credit report. For example, you don’t want to have 7 credit cards as your only tradelines on your credit report. This will hurt your credit score severely. Have a healthy mix of credit. For example, a mortgage, car loan, personal line of credit, two credit cards, and student loans.

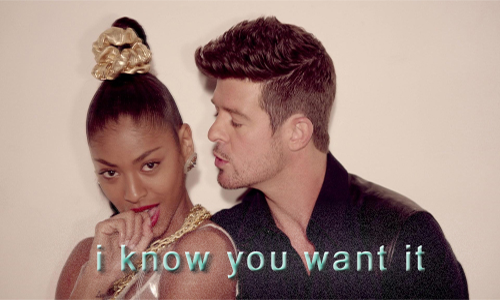

Want to be in full control of your credit? Take our iCredit class and become 37% more awesome. P.S., you choose the price of the course. #AlwaysBeLegendary

[fbcomments url=”urbanmoney.org/project/who-else-wants-a-high-credit-score/” width=”790″ count=”off” num=”30″ countmsg=”wonderful comments!”]